Over the previous year, start-up banks have actually shown that they have a shot at interfering with retail banking. These oppositions have actually collected a war chest of financing, revealed some enthusiastic global growth strategies and brought in countless clients.

And yet, constructing a bank has actually shown to be even more difficult than constructing a start-up in basic. Retail banks aren’ t happy to relax and view start-ups consume their lunch. Here’ s an appearance back at the greatest relocations of the year from opposition banks, some patterns you need to watch on and the upcoming obstacles for those start-ups.

A year of aggressive development

Due to the regulative structure and the size of the marketplace, it is a lot easier to introduce an opposition bank in Europe compared to anywhere else on the planet. That’ s why opposition banks have actually been growing in Europe.

When a business gets a complete banking license from the reserve bank of a EU nation, the start-up can passport its license throughout all EU nations and run throughout the continent.

N26 raised a lots of cash in 2019: last January, the Berlin-based start-up revealed a $300 million financing round , raising another $170 million in July. The business is now valued at $3.5 billion.

With more than 3.5 million clients in Europe, N26 revealed some enthusiastic growth strategies. N26 is now reside in the U.S. and is currently preparing a launch in Brazil.

Revolut has actually likewise been strongly broadening in order to beat its rivals to brand-new markets. In addition to its house market in the U.K., Revolut is readily available throughout Europe. In 2019, the business broadened to Singapore and Australia and presently has at least 8 million users .

While Revolut revealed that it needs to release in the U.S. and Canada by the end of in 2015, the clock abandoned that forecast. The start-up has actually been extremely transparent about its growth strategies, despite the fact that it often indicates that you need to wait months and even years prior to a complete rollout.

For circumstances, Revolut revealed in September 2018 that it would release in New Zealand, Hong Kong and Japan “ in the coming months. ” It later on ended up being “ early 2019, ” then “ 2019. ” India, Brazil, South Africa, Mexico and the UAE have actually likewise all been pointed out eventually. Simply put: releasing a banking item in a brand-new nation is hard.

The U.S. is a tiresome market as you need to get a license in all 50 states to run throughout the nation

Monzo has actually been succeeding in the house in the U.K. It has actually brought in 3 million consumers and raised £ 113 million (~$144m) in financing in 2015 from Y Combinator’ s Continuity fund . It is broadening to the U.S., however the rollout has actually been sluggish.

Nubank is another well-funded opposition bank. Backed by Tencent, the start-up has actually raised a $400 million Series F round from TCV. According to the WSJ , the start-up has an assessment above $10 billion.

Originally from Brazil, Nubank broadened to Mexico and has strategies to broaden to Argentina.

Chime is significantly appearing like the larger gamer in the U.S., just recently raising a $500 million financing round and reached an evaluation of $5.8 billion. It just runs in the U.S.

Starling Bank and Atom Bank just run in the U.K. Bunq is based in Amsterdam with an item custom-made for the Netherlands, however it accepts clients throughout Europe.

This isn’ t implied to be an extensive list as it’ s ending up being significantly tough to cover all challenger banks.

Subscription-based service design

There are a couple of standard functions that different opposition banks from tradition retail banks. Registering is very easy and just needs a mobile app. The mobile app itself is typically a lot more sleek than conventional banking apps.

Users get a Mastercard or Visa debit card that interacts with the business’ s server for each deal. In this manner, users can get instantaneous alerts, block and unclog their cards and shut off some functions, such as foreign payments, ATM withdrawals and online deals.

Challenger banks generally consumers assure no markup charges on deals in foreign currencies, however there are often some limitations on this function.

So how do these business earn money? When you pay with your card, banks produce a small, small interchange charge of cash on each deal. It’ s truly little, however it might end up being severe income at scale with 10s of millions or numerous countless users.

Challenger banks likewise provide other monetary services like insurance coverage items, forex or customer credit. Some opposition banks establish those functions in home, however a number of those functions are really handled by external fintech partners. Opposition banks create a commission on those items.

But the most appealing item is exceptional memberships. While opposition banks began with complimentary accounts and low, transparent costs, they have actually been offering premium memberships for a repaired month-to-month charge.

Challenger banks have actually ended up being a software-as-a-service market with a freemium part

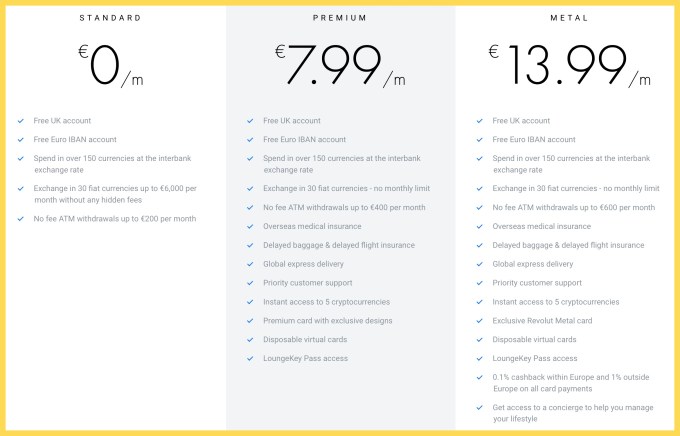

For example, Revolut uses premium represent € 7.99 monthly with greater limitations, some insurance coverage advantages that you’d anticipate from a premium card and access to innovative functions, such as cryptocurrencies and non reusable virtual cards. There’ s an extremely premium item for € 13.99 called Metal with a metal card style, cashback on card payments and access to a concierge function.

This appears a bit counterproductive, however premium memberships have actually been carrying out well, according to conversations with individuals operating in the market. You pay a lot in membership charges in order to prevent little transactional charges. (And you likewise get a cool card.)

Challenger banks have actually ended up being a software-as-a-service market with a freemium element. It causes a premium placing and high expectations from consumers.

Revolut’s charges peak at € 13.99/ month.

Upcoming difficulties

Read more: https://techcrunch.com/2020/01/04/2020-will-be-a-challenging-year-for-challenger-banks/

Recent Comments