A ban on “unfair” fees charged by lettings agents to tenants in England has started, two-and-a-half years after the plan was first announced.

It means tenants will no longer face fees for services including viewings, credit checks, references and setting up a tenancy.

Citizens Advice claims people renting privately in England have collectively been paying £13m a month in these fees.

Landlords say rents could rise and choice fall as a result of the ban.

The ban in England was first announced by Chancellor Philip Hammond in November 2016, when the government said it would become law “as soon as possible”. The detail of the new rules have been fiercely debated by all sides ever since.

“The new law means families and other renters don’t have to hand over hundreds of pounds every time they move home,” said Gillian Guy, chief executive at Citizens Advice.

A ban has been in place in Scotland since 2012, while Wales is set to implement its own rules in September, but the picture is more complicated in Northern Ireland, where a potential ban requires a sitting assembly to pass it.

What does the ban mean for tenants?

It has been the case that England’s five million private tenants faced various unavoidable fees every time they moved or renewed a tenancy.

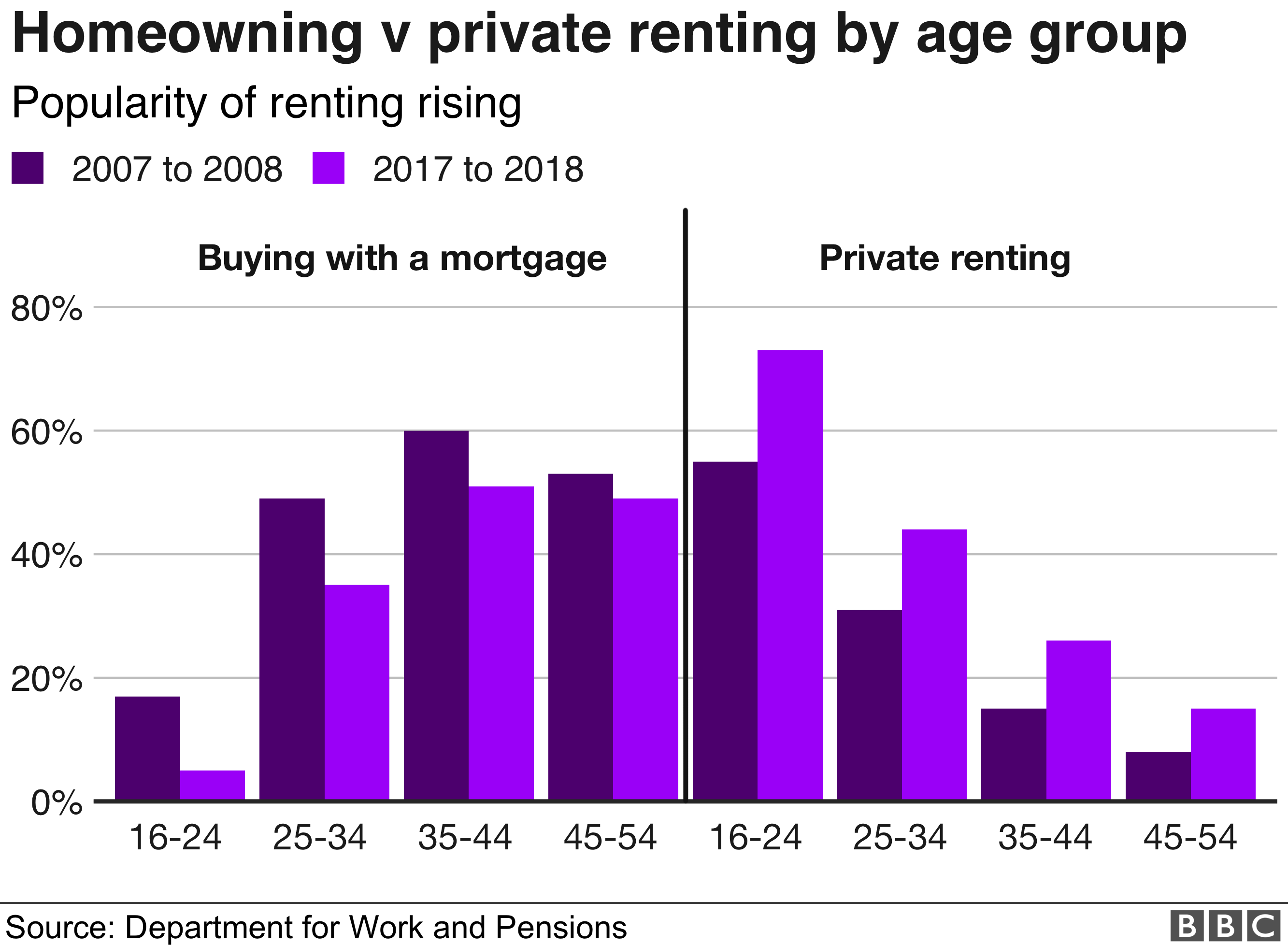

With renting becoming more widespread, including among middle-aged people, more people were caught up by these mostly upfront costs.

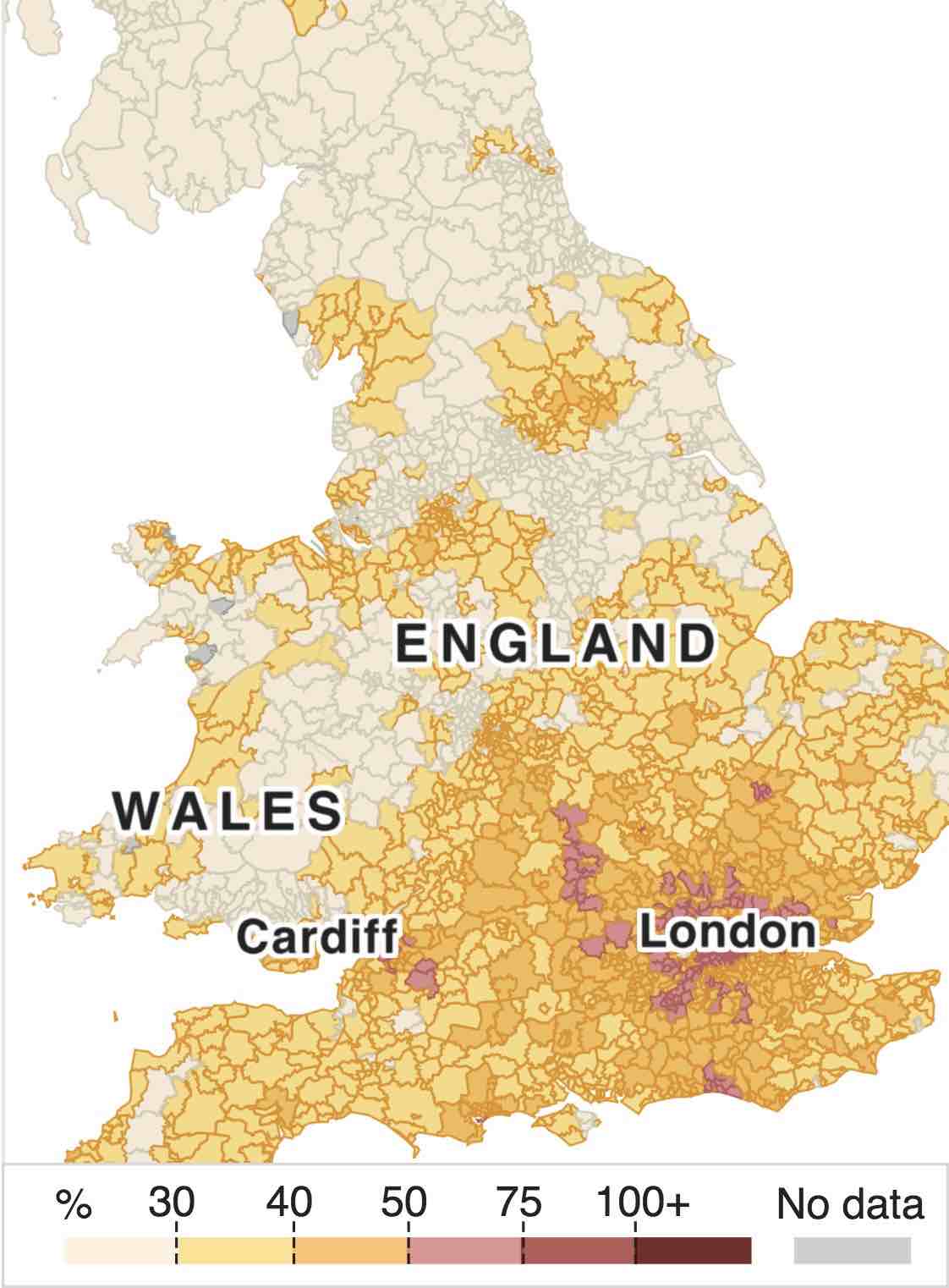

The level of fees had to be clearly displayed but varied significantly, with tenants in big cities facing the highest charges. Typically, this cost tenants £200 to £300 each time, although campaigners claimed the average was higher.

Fees may have been charged for administration, references from tenants’ employers, inventory checks and so on.

Agents, and ultimately landlords, will now have to pick up the cost of this work for new and renewed tenancies under the Tenant Fees Act. The new rules prevent them from simply charging a higher rent for the first month to cover the cost.

But Hannah Slater, from lobby group Generation Rent, said that moving house would still be expensive. So-called deposit alternative products – which include a fee – could end up being expensive for tenants, she added.

‘It was painful’

Kirsty McDermott has been forced to move twice when her landlords have sold up, and with each move has come the extra fees.

The 22-year-old hotel receptionist from Coventry said her landlords had been good, but the upfront charges had been a challenge.

“We saved up, but it was painful to hear that we had to pay £2,000 to move in,” she said, recalling the rent, deposit and fees.

“For young people, there is a lot of money pressure anyway. It was disappointing because it could have been money we could have put towards our own place.”

The new rules, she said, meant the money she would have paid in her next move could be put towards her future.

Many young adults have had the same experience. Charlotte Von Crease, a 27-year-old renter, recently told the BBC: “When we moved into our last property, we were hit with nearly £3,500 worth of fees before we even got the keys.”

What fees can tenants still face?

The new law does not mean tenants will not have to pay any upfront fees at all.

They will still be expected to pay the first month’s rent, and a deposit.

Following debate, the government settled on a rule that means security deposits will be limited to five weeks’ worth of rent for properties costing less than £50,000 annually to rent, or six weeks for higher-value renting. Holding deposits are capped at one week’s rent.

Additionally, there can be a charge for a lost key replacement, at close to the cost to the landlords themselves. If rent is outstanding for more than 14 days, then agencies can impose a penalty limited to 3% higher than the Bank of England’s base rate, which is 0.75% at present.

There might also be a fee of about £50 if a tenant requests a change to the tenancy, and also one if a tenant wants to leave the contract early.

Those who signed a tenancy agreement before 1 June may still face fees in their contract for the next 12 months, including renewal fees.

What do landlords and agents think?

An impact assessment from the government last year suggested the first year of the policy would collectively cost landlords nearly £83m, while letting agents would take a hit of £157m.

An agents’ trade body has described the new law as “the biggest change to hit the lettings industry in decades”.

Leona Leung, a landlord and lettings agency manager, said that agents would have to cover their cost and pass this on to the landlords. This could then be handed on to tenants in higher rent.

Housing charity Shelter argued that experience from the ban in Scotland suggested otherwise, saying that rises in rent had been “small and short-lived”, despite expectations that rents would increase.

Ms Leung said that other tax changes, such as the Insurance Premium Tax, had hit landlords – meaning that they were already facing tough cost pressures. All but the biggest companies could decide to self-manage their property or sell up.

“Many landlords will be asking whether it is a feasible business.” she said.

“The small landlords and local agents could be out of the business very soon. It is a loss for everyone – tenants, landlords and agents.”

Many agents are unhappy that they are facing higher costs as a result of overcharging by the unscrupulous few in the past.

Will this make renting more affordable?

This is a matter of debate, as the cost of renting a property has been rising on average in the UK.

The lower upfront costs will be a benefit, but there remains stiff competition for good-quality rented homes in some parts of the UK.

High demand could push up the cost of renting in these areas, irrespective of the one-off costs they may save on now.

Many tenants have also seen their wages remain relatively stagnant in recent years, although this has started to pick up.

- Join the conversation about renting costs on the BBC Affordable Living Facebook page

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

Your results

No affordable areas

Search the UK for more details about a local area

You have a big enough deposit and your monthly payments are high enough. The prices are based on the local market. If there are 100 properties of the right size in an area and they are placed in price order with the cheapest first, the “low-end” of the market will be the 25th property, “mid-priced” is the 50th and “high-end” will be the 75th.

Read more: https://www.bbc.co.uk/news/business-48474218

Recent Comments